By Liz Slocum Jensen May 15, 2018

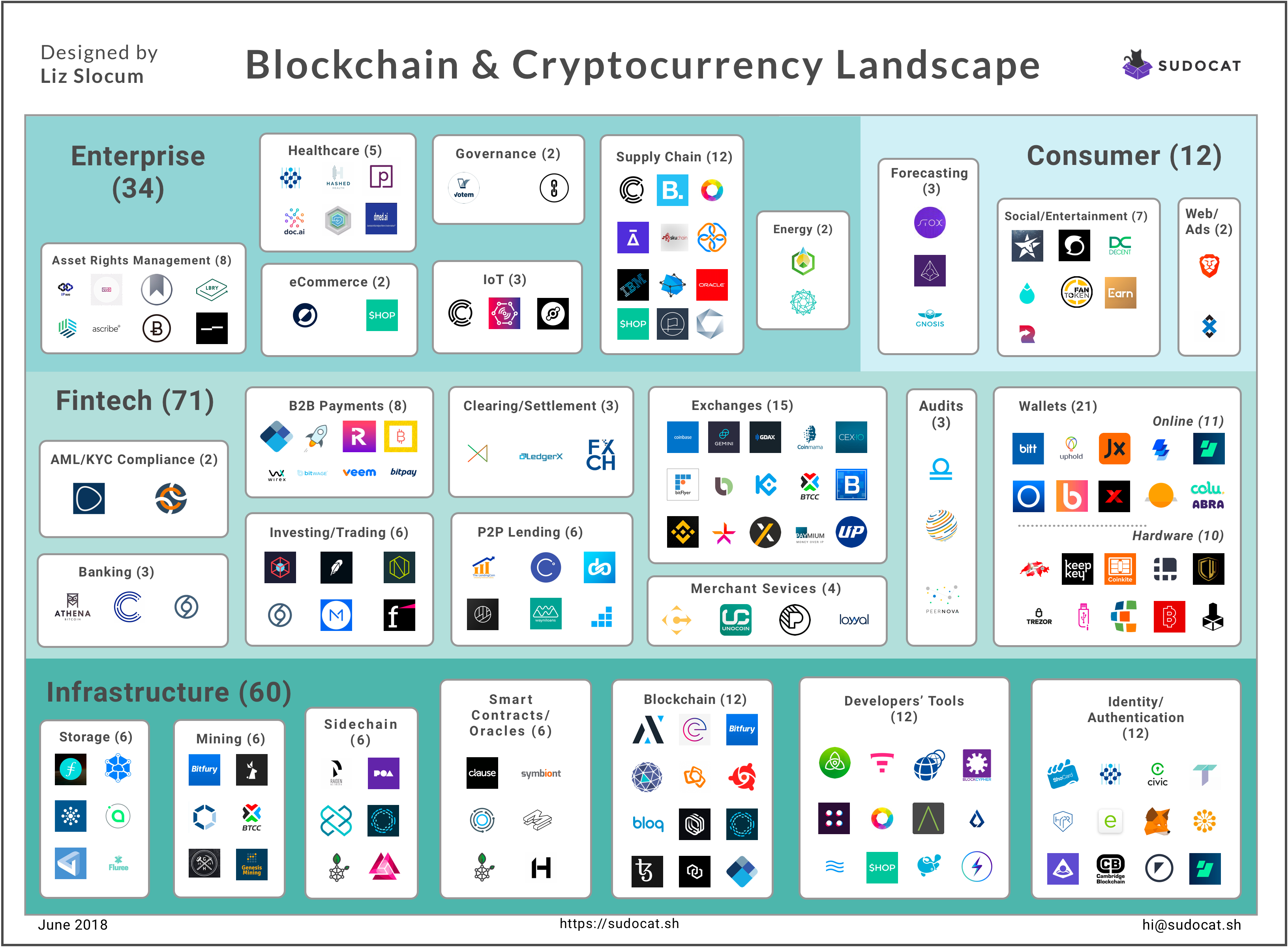

Here’s our overview of the Blockchain and Cryptocurrency Market Landscape. The infographic below is a sample of companies in this market.

The blockchain market is more than just fintech. Distilling the market further allows us to see the current status, trends, and opportunities. The three major ways to view blockchain tech are

We made an effort to include only companies with live products, although there are a few exceptions with only MVP’s.

For an interactive version of this infograph, please click here.

Enterprise/Consumer

Asset Rights Management: Helps creators manage the rights of their contents and assets. Companies like Binded and Alexandria and are helping digital content creators manage their photos, music, and other copyrighted material.

Energy: The energy market, including peer-to-peer energy trading, like Greenium.

Forecasting: Companies like Stox offer prediction markets on any event from weather to financial markets.

Governance: Services, including Votem, offer voting services for governments, HOAs, Board of Directors. Bitnation offers the ability to create a decentralized borderless nation.

IoT: Enterprise Internet of Things solutions, such as from Helium and Filament are often used for supply chain management tracking. Companies like Clause are working on smart contracts for IoT devices on blockchains.

Supply Chain: Tracing the flow of raw materials and goods from source to current status to final destination. Common applications include retail (Provenance), shipping, luxury goods, and pharmaceuticals (Chronicled).

Healthcare: Includes telemedicine, AI image analysis (dmed.ai, and credential/identity authentication (Intiva Health).

eCommerce: Companies like SHOP, specialize in retail and have a developers’ platform for retail apps in addition to a supply chain offering.

Social/Entertainment: Social media (Steemit), sports, gaming (Unikrn), and social networking.

Web/Ads: This space includes a advertising network service and the Brave web browser that emphasizes security and privacy with an ad blocker.

Fintech

AML/KYC Compliance: Forensic services, such as Elliptic, help with Anti-Money Laundering and Know-Your-Customer Compliance.

Banking: Banking services, including ATMs such as Athena.

B2B Payments: Payment and remittance services for business to business, including BitPay and BitPesa.

Investing/Trading: Funding, Investing, Trading services and protocols, including Zen Protocol and Neufund.

Clearing/Settlement: Clearing (FxCH) and Settlement (Setl) services for financial transactions.

P2P Lending: Peer-to-peer lending, such as Bitbond.

Exchanges: Cryptocurrency exchange markets including Coinbase and Kraken . Most have their own wallets.

Wallets: Online services such as Abra and hardware “vault” wallets such as TREZOR.

Audits: Financial transaction records for audits, including Factom.

Merchant Services: Services that help merchants accept cryptocurrency like DotDashPay, and loyalty programs like loyyal.

Infrastructure

Blockchain: These companies, such as Chain, work on distributed ledgers for public or private blockchains.

Storage: Databases or distributed files systems, including Storj.

Mining: Companies that mine or sell mining hardware and cloud mining services such as Genesis Mining.

Sidechain: Off-chain middleware such as POA Network. Sidechains will be key to the scalability of the blockchain ecosystem because it connects the blockchain to other technologies and helps mitigate the slow transaction times on public blockchains.

Smart Contracts/Oracle: A smart contract is a digital agreement that is triggered when pre-defined conditions are met. Oracles (like Moracle) verify real world data, like weather or flight status, that are fed to smart contracts.

Developer Tools: These are developers’ tool, including Lisk and Multichain, for building blockchain apps -or Dapps- and services.

Identity/Authentication: This category is inclusive of identifying individuals (Shocard) and verifying accounts (Trustroot).

How did we verify these companies?

We are seeking out companies with live products. We did internet research and attended conferences and meetups in Silicon Valley. Even if we spoke with the companies in-person, it does not necessarily mean that they have a live product. We analyzed their websites, Reddit forums, social media accounts, and Github repositories.

Why did we not include ICO-only and whitepaper-only companies?

Building a company and bringing a product to market is really hard. Companies with whitepapers or pre-product ICO’s are selling the dream and a majority fall between hype and scam. There are many pre-product ICO’s with the promise of building a team and then a product. Companies in this category are in the ideation phase and might not make it off the ground; no matter how much money their ICO raises. We are looking for companies that are actively adding value to the blockchain ecosystem with a product or service.

We strive to feature the most promising companies, but if you don’t see your company, please contact us.

Are you interested in the full list of blockchain and cryptocurrency?

We have a curated list of over 260 companies that are categorized by sector and then rated based on the following scale:

- Live product

- Promising:

- Live MVP or

- No active MVP, but are likely building or

- Existing non-blockchain product that is in an adjacent tech market.

- Whitepaper only: There is no active MVP. There was only an ICO. The Github and social media accounts are stale.